financial literacy for kids Archives - Homey App for Families

How to Teach Kids about a Checking Account

While most people tend to use debit and credit cards for their daily transactions and bill paying methods, there comes a time for use of a checking account. If you’re old enough, you may recall being taught how to write checks and balance a checkbook. With the current state of technology, many kids are learning about electronic forms of payment and bank accounts rather than the old school checking account methods.

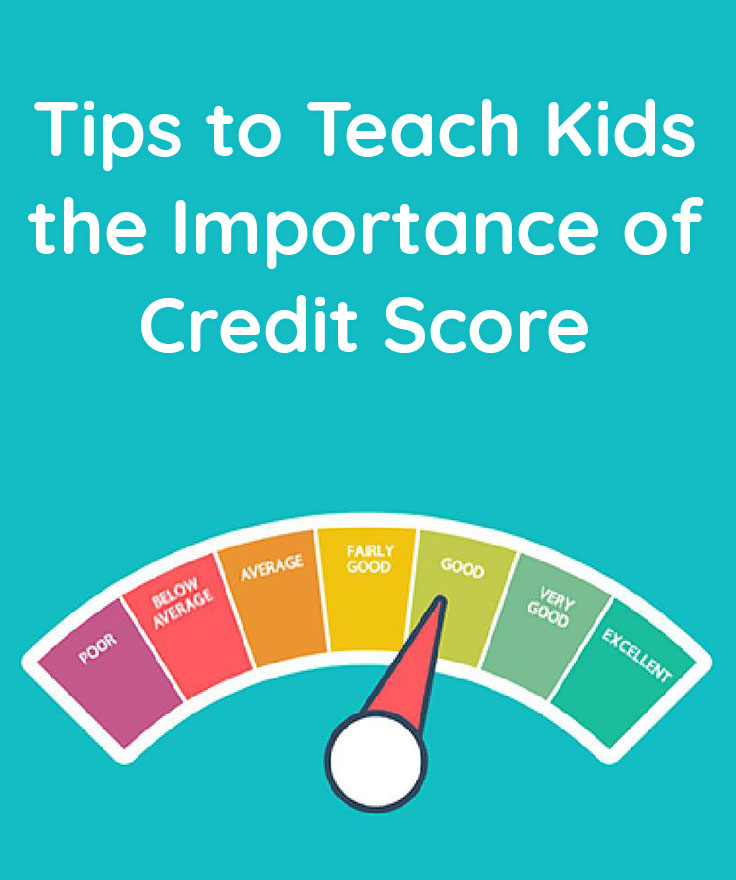

Tips to Teach Kids the Importance of Credit Score

The role of a parent is to teach their kids valuable skills such as manners, social etiquette and smaller tasks like tying their shoelaces or brushing their teeth. A parent’s job is never ending but oh so rewarding. But, one of the areas that many parents neglect to focus on is teaching their kid the importance of a credit score. Your kid may think a credit score is just another number that doesn’t matter or they have no idea what a credit score is. This all depends upon how involved with the finances your kids have been. Today I want to give you some tips on how to teach kids the importance of a credit score.

How to Explain Money to Kids in a Digital Age

Our previous advice of using see through jars to explain saving money to kids, and showing differences between each coin and bill is still valid. But the truth is, that the physical object of money has started to disappear. Digital age brings us even more use of credit cards. And it also adds to the mix smartphone apps and other methods to pay for items without handing over actual cash (or anything – not even a card). This can make teaching kids managing money a lot more difficult. You can’t only teach them about the physical paper and coin money. Kids will need to learn more about money in the digital age. Today I’m sharing a guide to help you explain digital money to kids in a digital age.

Our previous advice of using see through jars to explain saving money to kids, and showing differences between each coin and bill is still valid. But the truth is, that the physical object of money has started to disappear. Digital age brings us even more use of credit cards. And it also adds to the mix smartphone apps and other methods to pay for items without handing over actual cash (or anything – not even a card). This can make teaching kids managing money a lot more difficult. You can’t only teach them about the physical paper and coin money. Kids will need to learn more about money in the digital age. Today I’m sharing a guide to help you explain digital money to kids in a digital age.

Why is it Sometimes Good to Pay Kids for Chores?

The discussion of whether or not to pay kids for chores is an important topic to address. While the opinion on this subject varies from home to home, there is a benefit to paying kids for chores. Those households who pay for chores use the logical reasoning thought process that adults get paid to do their job, so why not pay kids to do their job as well. The other side of the picture thinks that kids shouldn’t be paid to do chores as they should be a part of life skills they simply need to learn to survive as adults. While both sides of the discussion have valid points, today I wanted to share a few reasons why paying kids for chores is beneficial for certain things.

Why It’s Important for Kids to Learn about Banking Early

It’s important that you think about your kid’s financial future as well as their health. It seems a parent often focuses on one area of growth throughout their days of raising children. It’s easy to get consumed with the basic life skills that you must teach a kid, but we often neglect to think about the bigger picture. Kids need to learn basic money management skills from a young age and having a bank account will help them learn this skill.

It’s important that you think about your kid’s financial future as well as their health. It seems a parent often focuses on one area of growth throughout their days of raising children. It’s easy to get consumed with the basic life skills that you must teach a kid, but we often neglect to think about the bigger picture. Kids need to learn basic money management skills from a young age and having a bank account will help them learn this skill.

Saving and Banking App for Kids

Teaching kids how to manage money is a vital part of parenthood but most often overlooked. As a means to help inspire kids to learn how to complete chores for money, Homey now released new financial literacy features. It allows parents to transfer kids’ chore earnings to an actual bank account to promote long term saving, enables kids to learn to manage their funds with the help of virtual saving jars, and offers families an adjustable system to track their chores and responsibilities.

Teaching kids how to manage money is a vital part of parenthood but most often overlooked. As a means to help inspire kids to learn how to complete chores for money, Homey now released new financial literacy features. It allows parents to transfer kids’ chore earnings to an actual bank account to promote long term saving, enables kids to learn to manage their funds with the help of virtual saving jars, and offers families an adjustable system to track their chores and responsibilities.