financial literacy Archives - Homey App for Families

4 Tips for Spending Money on Family Happiness

As a family, you may want to spend money from time to time on things that bring your family joy. Setting a specific budget that allows for expenditures on family happiness is very important.

If you have set up your household budget in a way that doesn’t allow for a little extra spending here and there, well then you should revisit your budget.

Today we are sharing 4 tips for spending money on family happiness. These ideas aren’t what you may have expected.

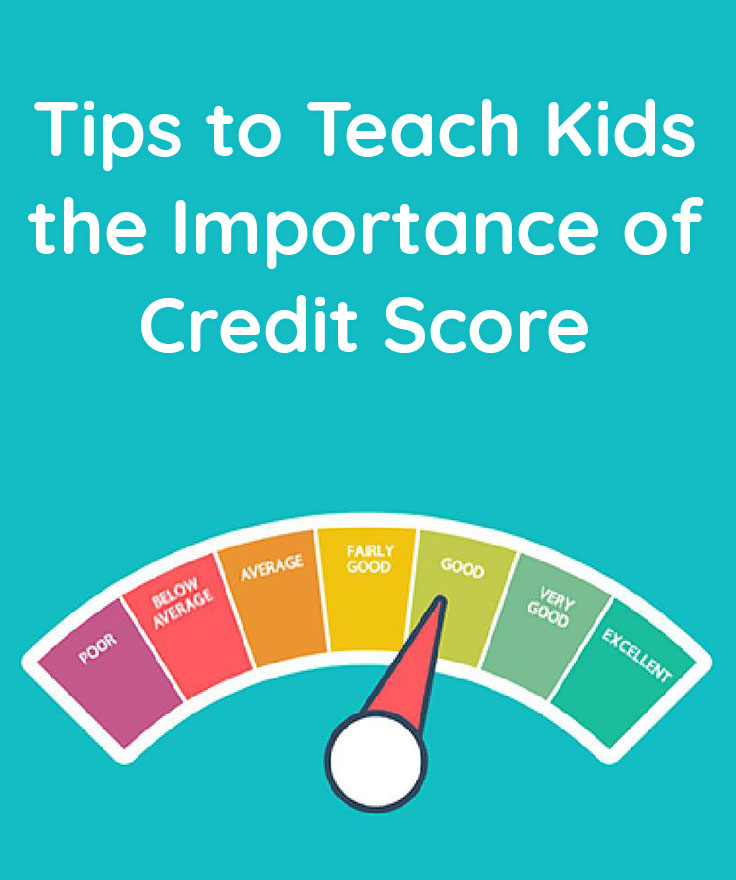

Tips to Teach Kids the Importance of Credit Score

The role of a parent is to teach their kids valuable skills such as manners, social etiquette and smaller tasks like tying their shoelaces or brushing their teeth. A parent’s job is never ending but oh so rewarding. But, one of the areas that many parents neglect to focus on is teaching their kid the importance of a credit score. Your kid may think a credit score is just another number that doesn’t matter or they have no idea what a credit score is. This all depends upon how involved with the finances your kids have been. Today I want to give you some tips on how to teach kids the importance of a credit score.

How to Teach Kids about Interest

Teaching kids about interest with bank accounts and saving money isn’t easy. This is something that may work best in visual, hands-on approach.

Teaching kids about interest with bank accounts and saving money isn’t easy. This is something that may work best in visual, hands-on approach.

Today we are sharing a few tips on how you can work to teach your kids about interest. It’s important kids learn how to be responsible with money and how to invest it properly into a savings account or, as they get older, a retirement fund.

Here’s our advice to get you started in the direction of teaching kids about interest.

Why is it Sometimes Good to Pay Kids for Chores?

The discussion of whether or not to pay kids for chores is an important topic to address. While the opinion on this subject varies from home to home, there is a benefit to paying kids for chores. Those households who pay for chores use the logical reasoning thought process that adults get paid to do their job, so why not pay kids to do their job as well. The other side of the picture thinks that kids shouldn’t be paid to do chores as they should be a part of life skills they simply need to learn to survive as adults. While both sides of the discussion have valid points, today I wanted to share a few reasons why paying kids for chores is beneficial for certain things.

What Kids Learn from an Allowance

Many parents struggle with teaching their kids about money because they don’t feel confident about the financial side of life as it is. There are some households who immediately feel an allowance is the right answer. They want to ensure their kids get a weekly allowance based on a list of chores that have to be completed. Then there are other households who feel chores should be a part of the kids’ day to day life because they need to be taught responsibilities. There is no correct answer when it comes to providing your own kid an allowance or not, it’s all about what works best in your household to go along with your views on this subject.

Many parents struggle with teaching their kids about money because they don’t feel confident about the financial side of life as it is. There are some households who immediately feel an allowance is the right answer. They want to ensure their kids get a weekly allowance based on a list of chores that have to be completed. Then there are other households who feel chores should be a part of the kids’ day to day life because they need to be taught responsibilities. There is no correct answer when it comes to providing your own kid an allowance or not, it’s all about what works best in your household to go along with your views on this subject.

Why It’s Important for Kids to Learn about Banking Early

It’s important that you think about your kid’s financial future as well as their health. It seems a parent often focuses on one area of growth throughout their days of raising children. It’s easy to get consumed with the basic life skills that you must teach a kid, but we often neglect to think about the bigger picture. Kids need to learn basic money management skills from a young age and having a bank account will help them learn this skill.

It’s important that you think about your kid’s financial future as well as their health. It seems a parent often focuses on one area of growth throughout their days of raising children. It’s easy to get consumed with the basic life skills that you must teach a kid, but we often neglect to think about the bigger picture. Kids need to learn basic money management skills from a young age and having a bank account will help them learn this skill.

How to Explain Credit Cards to Kids

There’s much discussion about teaching kids to be financially responsible but what about credit responsibility?

There’s much discussion about teaching kids to be financially responsible but what about credit responsibility?

There comes a time in every parent’s life when they have to explain credit cards to kids. While this may seem like something you don’t really desire to explain, it’s necessary.

Credit matters more than just the plastic cards you carry in your wallet or purse. It’s time to start explaining credit cards to kids so that they know the true impact of using such a plastic item.

Budgeting for Kids: How to Make Allowance Last a Week

While there is much debate about paying kids an allowance, there are many benefits to implementing it. Paying kids some form of an allowance during their childhood is an easy way to teach them some budgeting skills. As most parents know, lessons instilled during childhood can go a long way into adulthood, allowing your child to grow up being able to manage money more efficiently.

While there is much debate about paying kids an allowance, there are many benefits to implementing it. Paying kids some form of an allowance during their childhood is an easy way to teach them some budgeting skills. As most parents know, lessons instilled during childhood can go a long way into adulthood, allowing your child to grow up being able to manage money more efficiently.

If you are someone who pays their children allowance on a weekly basis and finds that kids are blowing their cash way too quickly, then read on for some tips on how to teach kids to budget their allowance so that it lasts all week long.