Although banks won’t approve credit cards for kids under the age of 18, a lot of kids now have and use credit cards as the authorised users on their parents accounts.

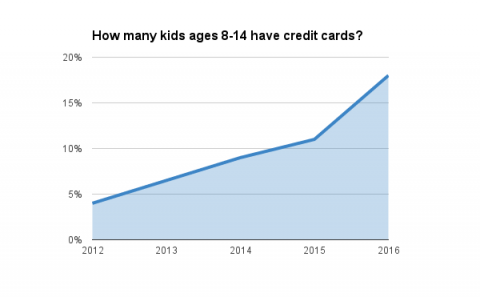

A 2016 Parents, Kids & Money survey conducted by T. Rowe Price revealed that 18% of children ages 8-14 now have access to credit cards, even if as much as 66% of parents believe kids should be at least 15 to get access to their first credit card. The number of kids with credit cards has actually more than quadrupled in the last four years!

But banks have their reasons to stay hesitant – because while an early credit card usage can help build up a good credit score, slip-ups can be costly and have long-term consequences.

A workaround that a lot of parents use is to add kids on their own credit cards as authorized users and then setting up a spending limit on their card. This enables kids to use the credit card freely when they need to, but parents can still monitor spending.

Another workaround are prepaid cards, which are often re-loadable, and offered by major card companies like Visa and MasterCard. This way kids can only spend as much money as there is on the card and there is no way for them to get into credit debt. The majority of prepaid cards can be used everywhere a normal debit card could be – which means kids can also use them online, for instance in the app store.

But why should kids have plastic cards?

What’s wrong with good old paper money? Parents that give credit or debit cards to their children say that having a card teaches kids how to manage spending early on and it also makes managing allowance a lot easier – especially for those that have multiple kids, and even more for those that connect allowance to chores.

Kids also increasingly want to spend their money online – in the App Store, on Google Play, on their Xbox Live account or on Amazon. 31% of kids nowadays have an online or gaming account, and big data on the kind of rewards families set up in our chore management app Homey has confirmed that.

Having paper money makes things complicated for kids that wish for gems to use in their favourite game, as they first have to buy gift cards in the store to spend their funds, so they often resort to asking parents to buy these things for them. And having a credit card or a prepaid debit card enables them purchasing power online, while still providing parents with means to limit and monitor the spending.

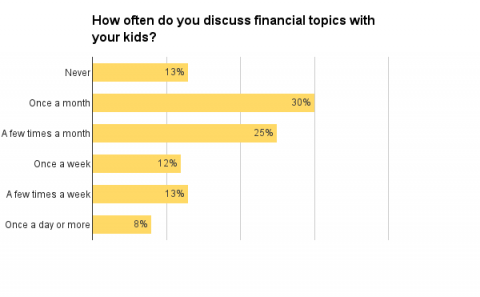

In any case, if kids do get access to plastic money, this is a good opportunity to start the discussion about money and spending with your kids, since 43% of parents don’t discuss financial topics regularly with their kids – like importance of saving, spending wisely, setting financial goals and budgeting.

As a parent, working with your children to differentiate between needs and wants will go a long way toward keeping them out of trouble.

Source: T. Rowe Price Parents, Kids & Money survey