Blog

Tricks to Learn Better Saving Habits as a Family

Saving money is the first step to true financial freedom. You cannot live life financially free if you need to borrow money often or are creating more debt than you can pay off. The problem so many families have, is finding a way to save that works for them. There are so many different methods, and it sometimes takes learning the tips and tricks of the trade, trying, and failing a few times before you find a way to save as a family. If you’re in this together, you are more likely to succeed.

4 Skills You Should Be Teaching Your Children

There are so many things that children need to know as they grow up. It can seem overwhelming as their parent, especially when it comes to teaching them to be safe and responsible. Here are a few areas that you should be focusing on.

There are so many things that children need to know as they grow up. It can seem overwhelming as their parent, especially when it comes to teaching them to be safe and responsible. Here are a few areas that you should be focusing on.

Jobs vs Responsibilities for Kids

There is much talk about how to define a chore that perhaps you pay money for a child to do, versus an actual responsibility which is more about teaching necessary life skills. When you’re trying to figure out what jobs will be assigned and what duties will be everyday responsibilities, it’s important to think about the difference between the two. Today I’m showcasing the differences between jobs and responsibilities, the way they work in our family. Maybe it helps you assign jobs and responsibilities to your children.

There is much talk about how to define a chore that perhaps you pay money for a child to do, versus an actual responsibility which is more about teaching necessary life skills. When you’re trying to figure out what jobs will be assigned and what duties will be everyday responsibilities, it’s important to think about the difference between the two. Today I’m showcasing the differences between jobs and responsibilities, the way they work in our family. Maybe it helps you assign jobs and responsibilities to your children.

Board Games That Enhance Money Skills

Developing a confidence in financial skills within your children is not be completed overnight. This concept of teaching kids to be good with money, so that they learn to be financially savvy is a work in progress through all of their childhood. With that being said, there are many ways we can work with kids to help enhance their money skills. To have some fun with kids while educating them on money matters, you can try a board game night. There many board games on the market that enhance money skills, here are just a few ideas for family board game night that will help enhance your kid’s money skills.

Developing a confidence in financial skills within your children is not be completed overnight. This concept of teaching kids to be good with money, so that they learn to be financially savvy is a work in progress through all of their childhood. With that being said, there are many ways we can work with kids to help enhance their money skills. To have some fun with kids while educating them on money matters, you can try a board game night. There many board games on the market that enhance money skills, here are just a few ideas for family board game night that will help enhance your kid’s money skills.

How to Include Kids in Household Budget Plans

You may have grown up in a household where kids were not a part of the everyday budget planning. Back in the day parents were more private about financial matters, but I’ve found that involving kids at an age-appropriate level with household budget plans helps them become financially savvy adults. While I’m not telling you to divulge all your household finances, perhaps there’s a middle ground where you can include kids in the household budget plans. Today we’re sharing some tips on how you can include the kids in this process so that they have stronger comprehension skills when it comes to money management.

You may have grown up in a household where kids were not a part of the everyday budget planning. Back in the day parents were more private about financial matters, but I’ve found that involving kids at an age-appropriate level with household budget plans helps them become financially savvy adults. While I’m not telling you to divulge all your household finances, perhaps there’s a middle ground where you can include kids in the household budget plans. Today we’re sharing some tips on how you can include the kids in this process so that they have stronger comprehension skills when it comes to money management.

Tricks to Get Through a Financial Emergency as a Family

Good money management is the foundation of any successful family. You should always make withdrawals using money you already have, instead of money you haven’t earned yet. Most of us know the basics but putting good financial habits into practice is often a different story. Review several tips to help you overcome a family-wide financial emergency.

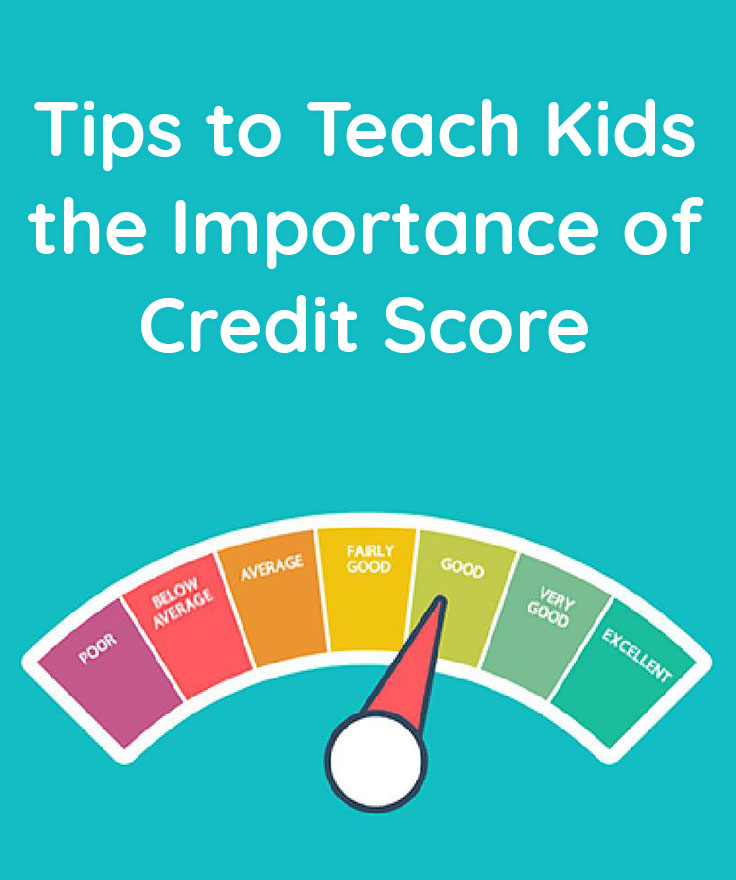

Tips to Teach Kids the Importance of Credit Score

The role of a parent is to teach their kids valuable skills such as manners, social etiquette and smaller tasks like tying their shoelaces or brushing their teeth. A parent’s job is never ending but oh so rewarding. But, one of the areas that many parents neglect to focus on is teaching their kid the importance of a credit score. Your kid may think a credit score is just another number that doesn’t matter or they have no idea what a credit score is. This all depends upon how involved with the finances your kids have been. Today I want to give you some tips on how to teach kids the importance of a credit score.

5 Ways to Get Your Kids Comfortable at the Dentist’s

No one likes to go to the dentist, but most adults understand that it’s necessary. The problem comes in for parents of young children. How do you relieve their fear of the dentist without misleading them?

How to Encourage your Teen to Save Money

It may seem like a difficult challenge to teach your teen to save money. The teen years are certainly full of new challenges and most parents aren’t quite sure how they will survive. Reality is, every parent before you survived the teen years just fine, and I’m sure that you will too. One of the things that teens are starting to navigate on their own is money. With all the spending possibilities on offer right now, teens might not have much interest in saving for the future.

It may seem like a difficult challenge to teach your teen to save money. The teen years are certainly full of new challenges and most parents aren’t quite sure how they will survive. Reality is, every parent before you survived the teen years just fine, and I’m sure that you will too. One of the things that teens are starting to navigate on their own is money. With all the spending possibilities on offer right now, teens might not have much interest in saving for the future.

Today I want to showcase a few simple ways you can encourage your teen to save money so that they learn to be financially savvy adults.

How to Make Your Next Family Vacation a Breeze

There’s nothing like taking time for a relaxing vacation with your family. When it’s done right, you all create memories that last a lifetime. But vacations often become far more stressful than they should be, and much of that is because of poor planning. Here are a few of the top tips to help you plan a fantastic family vacation.