Uncategorized Archives - Page 2 of 3 - Homey App for Families

Frugal Housekeeping Tips to Teach Your Kids

Teaching your children general housekeeping can be tricky in and of itself. Kids tend to use a little bit extra of everything, including a lot more soap and paper towels than needed, which can really hurt your wallet over time. Especially if you have a big family with a lot of kids, where it’s hard to even find who the culprit is, while you’re figuring out where all the dish soap that you just refilled went.

Teaching your children general housekeeping can be tricky in and of itself. Kids tend to use a little bit extra of everything, including a lot more soap and paper towels than needed, which can really hurt your wallet over time. Especially if you have a big family with a lot of kids, where it’s hard to even find who the culprit is, while you’re figuring out where all the dish soap that you just refilled went.

Luckily, there are a few simple tips and tricks you can use to teach your kids to save money while still keeping the house clean and kids happy to help. And the lessons are universal and good for all the children to learn! Here are three frugal housekeeping tips to teach your kids and get them in the habit of doing.

Why Should Kids Give to Charity

Giving to charity is important for many people. It makes you feel good and it makes others feel good. When one helps others through the act of giving to charity it becomes an act of kindness that goes around in circles and comes back tenfold.

Giving to charity is important for many people. It makes you feel good and it makes others feel good. When one helps others through the act of giving to charity it becomes an act of kindness that goes around in circles and comes back tenfold.

When it comes to kids giving to charity, one has to handle it a little differently. The younger your kids are the less likely they are to comprehend what giving to charity really means.

It is still important you introduce the concept of donating, as it helps teach very important life skills.

Simple Ways Kids Can Earn Extra Money

Letting your kids earn extra money is a great way to start teaching them financial skills. Many parents have found out the hard way that schools do not teach much in the area of money matters. When it comes to kids, this is a life skill that is necessary and will easily help mold them into being financially responsible adults. One of these important skills is learning how to earn money, and also how to find opportunities to do so.

Letting your kids earn extra money is a great way to start teaching them financial skills. Many parents have found out the hard way that schools do not teach much in the area of money matters. When it comes to kids, this is a life skill that is necessary and will easily help mold them into being financially responsible adults. One of these important skills is learning how to earn money, and also how to find opportunities to do so.

Teaching kids how to be financially intelligent doesn’t require a whole lot of effort. There are many simple ways kids can earn extra money and today we will showcase some ideas to help guide you forward in allowing your kids to earn extra cash to spend or save.

What is an ESA and Why Does My Child Need One?

Paying for a child’s college education is often a huge financial challenge parents. Even a public college can cost tens of thousands of dollars annually.

Paying for a child’s college education is often a huge financial challenge parents. Even a public college can cost tens of thousands of dollars annually.

One option is simply to add a savings account to your personal banking accounts. However, what your child might really need is a tax-advantaged savings plan such as a Coverdell Educational Savings Account.

This way your kids can use their savings accounts for things they wish for and learn goal setting and financial planning. Read on to learn more about what is an educational savings account and how to open one.

Why You Should Take Your Kids Shopping

Most parents look for ways to avoid taking their kids to the stores at all costs. Let’s face it; bringing your kids out shopping isn’t really fun for anyone. The kids get bored and parents get tired of fighting the many “I am bored” statements their kids will say throughout the entire shopping trip.

Most parents look for ways to avoid taking their kids to the stores at all costs. Let’s face it; bringing your kids out shopping isn’t really fun for anyone. The kids get bored and parents get tired of fighting the many “I am bored” statements their kids will say throughout the entire shopping trip.

The only thing worse than that is having everyone stare at you when you make your kids cry when you tell them that you won’t buy them more candy and toys.

With that being said, there is a reason you should start taking your kids shopping with you. There are many money lessons a kid can learn when you take them shopping.

3 Most Important Money Lessons For Kids

Financial skills are one of the most vital components of adulthood, yet few schools teach money lessons. This is a surprising fact for many kids around the world. Financial skills are simply not placed at a high level of importance comparative to reading and mathematics. Sure one could argue that mathematics is the foundation for financial skills, however, learning about money isn’t simply learning numbers. As a parent you know it is your job to equip your kids with the skills they need to survive in the world. Money lessons rank pretty high on the list of skills parents must focus on teaching kids, and so today we are sharing 3 most important money lessons to teach kids so that you can move forward in raising financially smart kids.

Financial skills are one of the most vital components of adulthood, yet few schools teach money lessons. This is a surprising fact for many kids around the world. Financial skills are simply not placed at a high level of importance comparative to reading and mathematics. Sure one could argue that mathematics is the foundation for financial skills, however, learning about money isn’t simply learning numbers. As a parent you know it is your job to equip your kids with the skills they need to survive in the world. Money lessons rank pretty high on the list of skills parents must focus on teaching kids, and so today we are sharing 3 most important money lessons to teach kids so that you can move forward in raising financially smart kids.

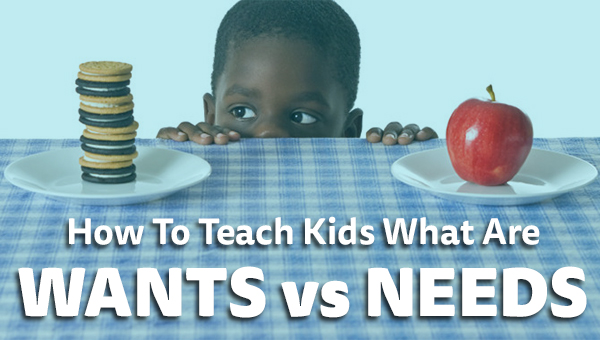

How to Teach Kids What are Wants vs Needs

As adults we are often faced with the challenge of determining what we spend our cash on. Whether we learned from a young age to develop a want vs a need strategy or not, many adults still struggle with this concept. As parents to kids it’s our job to start teaching financial lessons as early as possible to ensure our kids grow up without the difficulties of knowing how to determine where to spend their hard earned cash. Today let’s chat a bit about how you can teach kids a want vs a need so that they can be successful in their financial decisions.

As adults we are often faced with the challenge of determining what we spend our cash on. Whether we learned from a young age to develop a want vs a need strategy or not, many adults still struggle with this concept. As parents to kids it’s our job to start teaching financial lessons as early as possible to ensure our kids grow up without the difficulties of knowing how to determine where to spend their hard earned cash. Today let’s chat a bit about how you can teach kids a want vs a need so that they can be successful in their financial decisions.

What is your chore doing style?

A while back we were talking about how different people and families tackle chores. How some people find doing laundry relaxing and some dread the though of it. How some people sing and dance with the vacuum and how some find pleasure in manically scrubbing the bathtub. And especially how some want to see their entire family cleaning with them the whole Saturday evening and some just send everyone out so they can get the work really done.

A while back we were talking about how different people and families tackle chores. How some people find doing laundry relaxing and some dread the though of it. How some people sing and dance with the vacuum and how some find pleasure in manically scrubbing the bathtub. And especially how some want to see their entire family cleaning with them the whole Saturday evening and some just send everyone out so they can get the work really done.

So we came up with a scientific method of determining your chore doing style. It is 100% accurate and the results will help you navigate chores better. If you want to find out whether you belong among neat-freaks or total slobs, this fun quiz will help you learn exactly where you stand on the chore-doing spectre and it will also equip you with some tips on how to be more productive according to your personality.

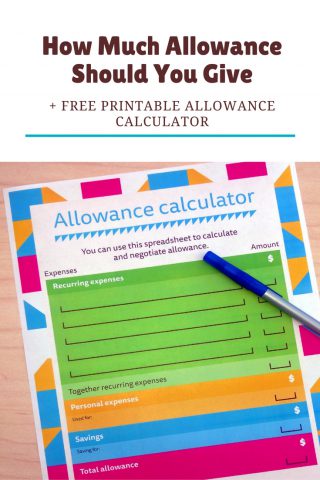

How much allowance should you give

While allowance is by no means a child’s right, it definitely is one of the best ways to teach children how to handle their finances. Kids need to learn the basics of money: where it comes from, how it should be spent and saved, and most importantly – that the resources are limited.

This is especially important now, when a lot of our own purchases are done online and kids don’t get to see money exchanging hands. It is easy to miss the facts that things cost money – even if we buy them online or with a credit card – which can cause financial troubles in their future.

How to teach kids to save money

A couple of years back, when I visited the store with my youngest, he would often wander into the toy aisle to look at newest and biggest toys in the colourful packages. He quickly learned that we don’t buy toys every time we visit the store, but sometimes he found a toy he just needed to have. He knew he can sometimes get something and the pleading began. The funny thing is that while some toys he wished for were indeed expensive, some were dirt cheap! Children often have no concept of the value of money beyond that we exchange it for goods.