Family Archives - Page 5 of 9 - Homey App for Families

Tricks to Get Through a Financial Emergency as a Family

Good money management is the foundation of any successful family. You should always make withdrawals using money you already have, instead of money you haven’t earned yet. Most of us know the basics but putting good financial habits into practice is often a different story. Review several tips to help you overcome a family-wide financial emergency.

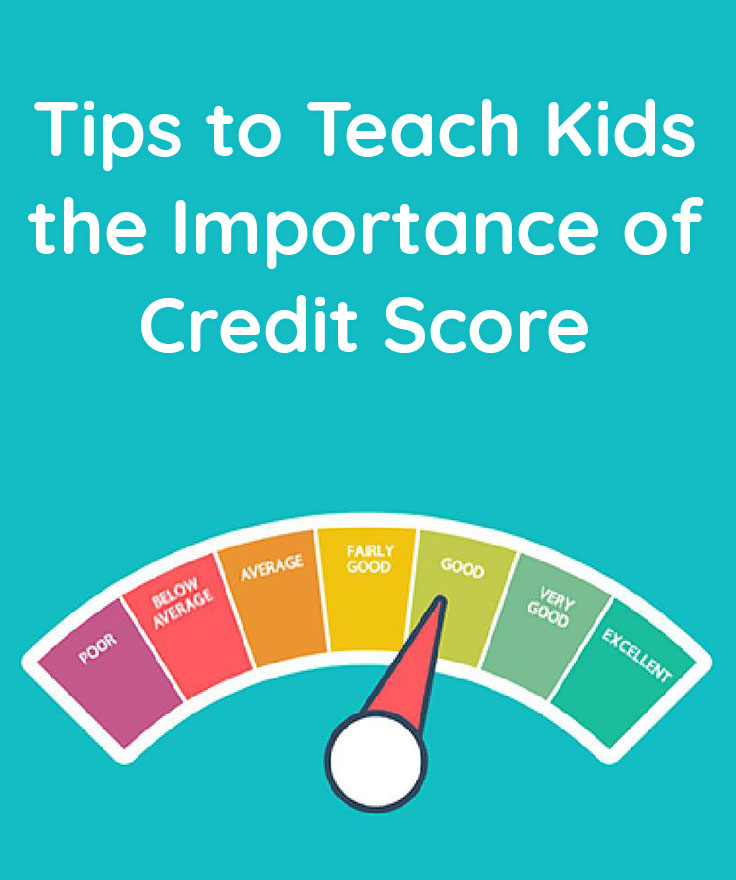

Tips to Teach Kids the Importance of Credit Score

The role of a parent is to teach their kids valuable skills such as manners, social etiquette and smaller tasks like tying their shoelaces or brushing their teeth. A parent’s job is never ending but oh so rewarding. But, one of the areas that many parents neglect to focus on is teaching their kid the importance of a credit score. Your kid may think a credit score is just another number that doesn’t matter or they have no idea what a credit score is. This all depends upon how involved with the finances your kids have been. Today I want to give you some tips on how to teach kids the importance of a credit score.

How to Encourage your Teen to Save Money

It may seem like a difficult challenge to teach your teen to save money. The teen years are certainly full of new challenges and most parents aren’t quite sure how they will survive. Reality is, every parent before you survived the teen years just fine, and I’m sure that you will too. One of the things that teens are starting to navigate on their own is money. With all the spending possibilities on offer right now, teens might not have much interest in saving for the future.

It may seem like a difficult challenge to teach your teen to save money. The teen years are certainly full of new challenges and most parents aren’t quite sure how they will survive. Reality is, every parent before you survived the teen years just fine, and I’m sure that you will too. One of the things that teens are starting to navigate on their own is money. With all the spending possibilities on offer right now, teens might not have much interest in saving for the future.

Today I want to showcase a few simple ways you can encourage your teen to save money so that they learn to be financially savvy adults.

How to Make Your Next Family Vacation a Breeze

There’s nothing like taking time for a relaxing vacation with your family. When it’s done right, you all create memories that last a lifetime. But vacations often become far more stressful than they should be, and much of that is because of poor planning. Here are a few of the top tips to help you plan a fantastic family vacation.

Big Spending: How to Begin Your Family’s Budgeting Journey

As daunting as the task may seem, building a family budget is important. Don’t complicate the task by trying to build a complicated spreadsheet, unless of course, you are an expert at this. Instead, old-fashioned paper and pencil can easily map the layout for your family budget. Below are five useful tips to help begin your family’s budgeting journey.

Five Home Apps Every Family Should be Using

Being a parent and homeowner is not easy. Raising a family takes a lot of work and responsibility and keeping up with regular home maintenance and repairs can quickly take a backseat to child-rearing and daily tasks. Luckily, there are quite a few tools available to help, and they fit perfectly in your palm. Here are five apps every family should be using.

Hands-on Money Teaching Tips for Parents

Teaching your kids about money is no easy feat.

Teaching your kids about money is no easy feat.

In addition, many of us parents themselves aren’t that great with money to being with. However, teaching basic skills like tracking spending, budgeting for purchases, and saving for long term goals and emergencies doesn’t have to go into much theoretical details. Learning can be practical and hands-on.

Today I’m sharing a few tips on how parents can use hands-on money teaching concepts to encourage kids to be financially savvy.

How to Explain Money to Kids in a Digital Age

Our previous advice of using see through jars to explain saving money to kids, and showing differences between each coin and bill is still valid. But the truth is, that the physical object of money has started to disappear. Digital age brings us even more use of credit cards. And it also adds to the mix smartphone apps and other methods to pay for items without handing over actual cash (or anything – not even a card). This can make teaching kids managing money a lot more difficult. You can’t only teach them about the physical paper and coin money. Kids will need to learn more about money in the digital age. Today I’m sharing a guide to help you explain digital money to kids in a digital age.

Our previous advice of using see through jars to explain saving money to kids, and showing differences between each coin and bill is still valid. But the truth is, that the physical object of money has started to disappear. Digital age brings us even more use of credit cards. And it also adds to the mix smartphone apps and other methods to pay for items without handing over actual cash (or anything – not even a card). This can make teaching kids managing money a lot more difficult. You can’t only teach them about the physical paper and coin money. Kids will need to learn more about money in the digital age. Today I’m sharing a guide to help you explain digital money to kids in a digital age.

How to Teach Kids about Interest

Teaching kids about interest with bank accounts and saving money isn’t easy. This is something that may work best in visual, hands-on approach.

Teaching kids about interest with bank accounts and saving money isn’t easy. This is something that may work best in visual, hands-on approach.

Today we are sharing a few tips on how you can work to teach your kids about interest. It’s important kids learn how to be responsible with money and how to invest it properly into a savings account or, as they get older, a retirement fund.

Here’s our advice to get you started in the direction of teaching kids about interest.

Why is it Sometimes Good to Pay Kids for Chores?

The discussion of whether or not to pay kids for chores is an important topic to address. While the opinion on this subject varies from home to home, there is a benefit to paying kids for chores. Those households who pay for chores use the logical reasoning thought process that adults get paid to do their job, so why not pay kids to do their job as well. The other side of the picture thinks that kids shouldn’t be paid to do chores as they should be a part of life skills they simply need to learn to survive as adults. While both sides of the discussion have valid points, today I wanted to share a few reasons why paying kids for chores is beneficial for certain things.