Family Archives - Page 4 of 9 - Homey App for Families

Good Habits to Teach Kids Early

Parenting is a tall order. The responsibility of raising children to be self-sustaining adults can be an overwhelming and near impossible process. However, there are a few universal lessons every parent should teach their children. These four habits last a lifetime and can contribute to your child’s overall success.

How to Save for Your New House as a Family

All potential homeowners should consider saving at least some money when in the market for a new home. When considering how to save, there are many ways you can consider to plan or educate yourself on money saving tips and tricks. Knowledge about what it takes to finance a home is also extremely important for kids. Here are a few points you can discuss as a family.

Summer Chore Ideas for Kids of All Ages

No matter how old your kids are, they will surely end up suffering from summer boredom at some point. Having the kids home full time this summer may sound overwhelming, but you’re in luck. There are ways you can keep your kids busy, while having fun too. Today we’re featuring summer chore ideas for kids of all ages. Enjoy this unique list of opportunity to give your kids something to do while you enjoy a clean yard, home and summer season.

What You Should Be Teaching Your Child About Mortgages

As your children continue to age, it is vital to start familiarizing them with critical financial concepts that will impact their future lives. One area that you should consider educating them in are mortgages and how they can help someone to buy a home. There are several tips that someone can follow that can help them to teach their kids more about mortgages, and set them up for financial security for the rest of their lives.

Online Activities That Are Educational and Fun

When it comes to entertaining kids when the weather is so bad it keeps them stuck indoors, you don’t have a better friend and ally than the internet. The web is an endless resource for activities and ideas that can entertain kids while stimulating their minds. You can even find ways to wear out hyper children with the help of the internet. We’ve gathered some of our favorite ways to keep kids entertained all in one place so you have plenty of great ideas for the next rainy day.

When it comes to entertaining kids when the weather is so bad it keeps them stuck indoors, you don’t have a better friend and ally than the internet. The web is an endless resource for activities and ideas that can entertain kids while stimulating their minds. You can even find ways to wear out hyper children with the help of the internet. We’ve gathered some of our favorite ways to keep kids entertained all in one place so you have plenty of great ideas for the next rainy day.

Tricks to Learn Better Saving Habits as a Family

Saving money is the first step to true financial freedom. You cannot live life financially free if you need to borrow money often or are creating more debt than you can pay off. The problem so many families have, is finding a way to save that works for them. There are so many different methods, and it sometimes takes learning the tips and tricks of the trade, trying, and failing a few times before you find a way to save as a family. If you’re in this together, you are more likely to succeed.

4 Skills You Should Be Teaching Your Children

There are so many things that children need to know as they grow up. It can seem overwhelming as their parent, especially when it comes to teaching them to be safe and responsible. Here are a few areas that you should be focusing on.

There are so many things that children need to know as they grow up. It can seem overwhelming as their parent, especially when it comes to teaching them to be safe and responsible. Here are a few areas that you should be focusing on.

Jobs vs Responsibilities for Kids

There is much talk about how to define a chore that perhaps you pay money for a child to do, versus an actual responsibility which is more about teaching necessary life skills. When you’re trying to figure out what jobs will be assigned and what duties will be everyday responsibilities, it’s important to think about the difference between the two. Today I’m showcasing the differences between jobs and responsibilities, the way they work in our family. Maybe it helps you assign jobs and responsibilities to your children.

There is much talk about how to define a chore that perhaps you pay money for a child to do, versus an actual responsibility which is more about teaching necessary life skills. When you’re trying to figure out what jobs will be assigned and what duties will be everyday responsibilities, it’s important to think about the difference between the two. Today I’m showcasing the differences between jobs and responsibilities, the way they work in our family. Maybe it helps you assign jobs and responsibilities to your children.

Board Games That Enhance Money Skills

Developing a confidence in financial skills within your children is not be completed overnight. This concept of teaching kids to be good with money, so that they learn to be financially savvy is a work in progress through all of their childhood. With that being said, there are many ways we can work with kids to help enhance their money skills. To have some fun with kids while educating them on money matters, you can try a board game night. There many board games on the market that enhance money skills, here are just a few ideas for family board game night that will help enhance your kid’s money skills.

Developing a confidence in financial skills within your children is not be completed overnight. This concept of teaching kids to be good with money, so that they learn to be financially savvy is a work in progress through all of their childhood. With that being said, there are many ways we can work with kids to help enhance their money skills. To have some fun with kids while educating them on money matters, you can try a board game night. There many board games on the market that enhance money skills, here are just a few ideas for family board game night that will help enhance your kid’s money skills.

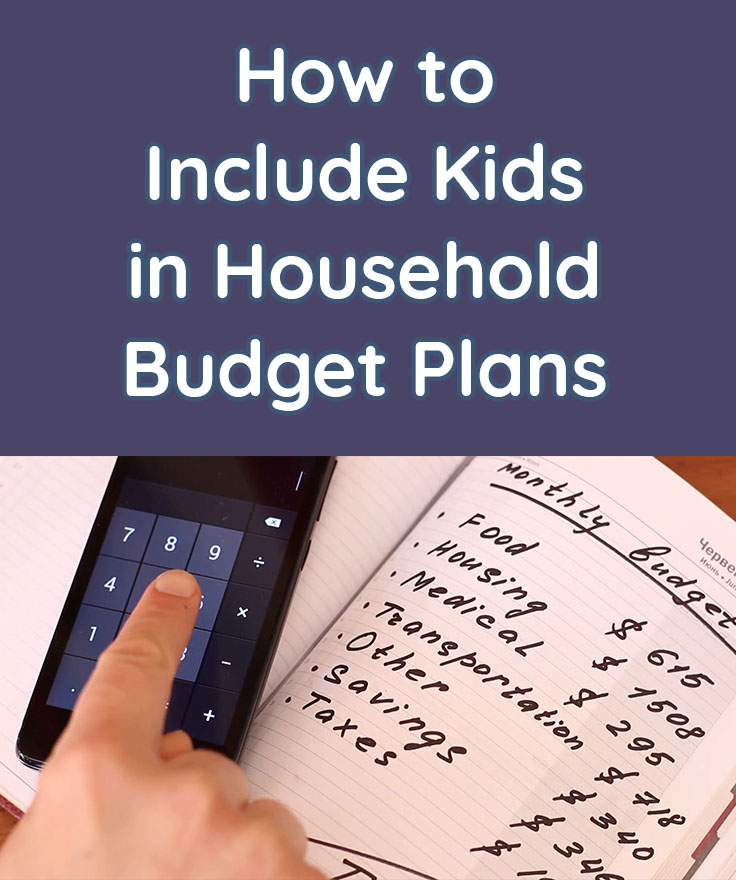

How to Include Kids in Household Budget Plans

You may have grown up in a household where kids were not a part of the everyday budget planning. Back in the day parents were more private about financial matters, but I’ve found that involving kids at an age-appropriate level with household budget plans helps them become financially savvy adults. While I’m not telling you to divulge all your household finances, perhaps there’s a middle ground where you can include kids in the household budget plans. Today we’re sharing some tips on how you can include the kids in this process so that they have stronger comprehension skills when it comes to money management.

You may have grown up in a household where kids were not a part of the everyday budget planning. Back in the day parents were more private about financial matters, but I’ve found that involving kids at an age-appropriate level with household budget plans helps them become financially savvy adults. While I’m not telling you to divulge all your household finances, perhaps there’s a middle ground where you can include kids in the household budget plans. Today we’re sharing some tips on how you can include the kids in this process so that they have stronger comprehension skills when it comes to money management.