financial literacy Archives - Page 2 of 3 - Homey App for Families

How to Include Kids in Household Budget Plans

You may have grown up in a household where kids were not a part of the everyday budget planning. Back in the day parents were more private about financial matters, but I’ve found that involving kids at an age-appropriate level with household budget plans helps them become financially savvy adults. While I’m not telling you to divulge all your household finances, perhaps there’s a middle ground where you can include kids in the household budget plans. Today we’re sharing some tips on how you can include the kids in this process so that they have stronger comprehension skills when it comes to money management.

You may have grown up in a household where kids were not a part of the everyday budget planning. Back in the day parents were more private about financial matters, but I’ve found that involving kids at an age-appropriate level with household budget plans helps them become financially savvy adults. While I’m not telling you to divulge all your household finances, perhaps there’s a middle ground where you can include kids in the household budget plans. Today we’re sharing some tips on how you can include the kids in this process so that they have stronger comprehension skills when it comes to money management.

Tricks to Get Through a Financial Emergency as a Family

Good money management is the foundation of any successful family. You should always make withdrawals using money you already have, instead of money you haven’t earned yet. Most of us know the basics but putting good financial habits into practice is often a different story. Review several tips to help you overcome a family-wide financial emergency.

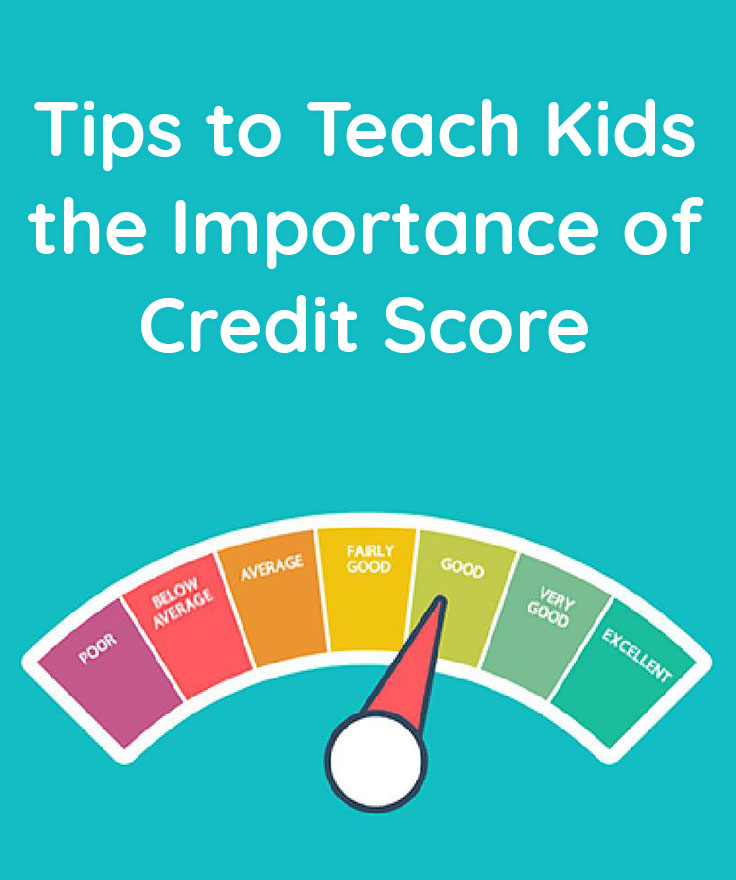

Tips to Teach Kids the Importance of Credit Score

The role of a parent is to teach their kids valuable skills such as manners, social etiquette and smaller tasks like tying their shoelaces or brushing their teeth. A parent’s job is never ending but oh so rewarding. But, one of the areas that many parents neglect to focus on is teaching their kid the importance of a credit score. Your kid may think a credit score is just another number that doesn’t matter or they have no idea what a credit score is. This all depends upon how involved with the finances your kids have been. Today I want to give you some tips on how to teach kids the importance of a credit score.

Hands-on Money Teaching Tips for Parents

Teaching your kids about money is no easy feat.

Teaching your kids about money is no easy feat.

In addition, many of us parents themselves aren’t that great with money to being with. However, teaching basic skills like tracking spending, budgeting for purchases, and saving for long term goals and emergencies doesn’t have to go into much theoretical details. Learning can be practical and hands-on.

Today I’m sharing a few tips on how parents can use hands-on money teaching concepts to encourage kids to be financially savvy.

How to Explain Money to Kids in a Digital Age

Our previous advice of using see through jars to explain saving money to kids, and showing differences between each coin and bill is still valid. But the truth is, that the physical object of money has started to disappear. Digital age brings us even more use of credit cards. And it also adds to the mix smartphone apps and other methods to pay for items without handing over actual cash (or anything – not even a card). This can make teaching kids managing money a lot more difficult. You can’t only teach them about the physical paper and coin money. Kids will need to learn more about money in the digital age. Today I’m sharing a guide to help you explain digital money to kids in a digital age.

Our previous advice of using see through jars to explain saving money to kids, and showing differences between each coin and bill is still valid. But the truth is, that the physical object of money has started to disappear. Digital age brings us even more use of credit cards. And it also adds to the mix smartphone apps and other methods to pay for items without handing over actual cash (or anything – not even a card). This can make teaching kids managing money a lot more difficult. You can’t only teach them about the physical paper and coin money. Kids will need to learn more about money in the digital age. Today I’m sharing a guide to help you explain digital money to kids in a digital age.

How to Teach Kids about Interest

Teaching kids about interest with bank accounts and saving money isn’t easy. This is something that may work best in visual, hands-on approach.

Teaching kids about interest with bank accounts and saving money isn’t easy. This is something that may work best in visual, hands-on approach.

Today we are sharing a few tips on how you can work to teach your kids about interest. It’s important kids learn how to be responsible with money and how to invest it properly into a savings account or, as they get older, a retirement fund.

Here’s our advice to get you started in the direction of teaching kids about interest.

Why is it Sometimes Good to Pay Kids for Chores?

The discussion of whether or not to pay kids for chores is an important topic to address. While the opinion on this subject varies from home to home, there is a benefit to paying kids for chores. Those households who pay for chores use the logical reasoning thought process that adults get paid to do their job, so why not pay kids to do their job as well. The other side of the picture thinks that kids shouldn’t be paid to do chores as they should be a part of life skills they simply need to learn to survive as adults. While both sides of the discussion have valid points, today I wanted to share a few reasons why paying kids for chores is beneficial for certain things.

What Kids Learn from an Allowance

Many parents struggle with teaching their kids about money because they don’t feel confident about the financial side of life as it is. There are some households who immediately feel an allowance is the right answer. They want to ensure their kids get a weekly allowance based on a list of chores that have to be completed. Then there are other households who feel chores should be a part of the kids’ day to day life because they need to be taught responsibilities. There is no correct answer when it comes to providing your own kid an allowance or not, it’s all about what works best in your household to go along with your views on this subject.

Many parents struggle with teaching their kids about money because they don’t feel confident about the financial side of life as it is. There are some households who immediately feel an allowance is the right answer. They want to ensure their kids get a weekly allowance based on a list of chores that have to be completed. Then there are other households who feel chores should be a part of the kids’ day to day life because they need to be taught responsibilities. There is no correct answer when it comes to providing your own kid an allowance or not, it’s all about what works best in your household to go along with your views on this subject.

Tips for Teaching Kids Responsible Spending

A big part of teaching your kids to be financially responsible is to practice what you preach. Kids learn by the example that you set. If you are not committed to spending responsibly and using good saving and money habits yourself, your children are unlikely to learn this skill. Here are some ways to help your kids learn the value of money in real-life ways.

Fun Ways to Teach Your Kids How to Manage Money

Teaching kids healthy habits starts early and lasts their whole life. However, lecturing your child about the importance of money may not sound appealing to you or your child. Teaching money management doesn’t have to be dull. It can be quite fun!