Brandy Ellen, Author at Homey App for Families

4 Tips for Spending Money on Family Happiness

As a family, you may want to spend money from time to time on things that bring your family joy. Setting a specific budget that allows for expenditures on family happiness is very important.

If you have set up your household budget in a way that doesn’t allow for a little extra spending here and there, well then you should revisit your budget.

Today we are sharing 4 tips for spending money on family happiness. These ideas aren’t what you may have expected.

How to Teach Kids about a Checking Account

While most people tend to use debit and credit cards for their daily transactions and bill paying methods, there comes a time for use of a checking account. If you’re old enough, you may recall being taught how to write checks and balance a checkbook. With the current state of technology, many kids are learning about electronic forms of payment and bank accounts rather than the old school checking account methods.

Summer Chore Ideas for Kids of All Ages

No matter how old your kids are, they will surely end up suffering from summer boredom at some point. Having the kids home full time this summer may sound overwhelming, but you’re in luck. There are ways you can keep your kids busy, while having fun too. Today we’re featuring summer chore ideas for kids of all ages. Enjoy this unique list of opportunity to give your kids something to do while you enjoy a clean yard, home and summer season.

Jobs vs Responsibilities for Kids

There is much talk about how to define a chore that perhaps you pay money for a child to do, versus an actual responsibility which is more about teaching necessary life skills. When you’re trying to figure out what jobs will be assigned and what duties will be everyday responsibilities, it’s important to think about the difference between the two. Today I’m showcasing the differences between jobs and responsibilities, the way they work in our family. Maybe it helps you assign jobs and responsibilities to your children.

There is much talk about how to define a chore that perhaps you pay money for a child to do, versus an actual responsibility which is more about teaching necessary life skills. When you’re trying to figure out what jobs will be assigned and what duties will be everyday responsibilities, it’s important to think about the difference between the two. Today I’m showcasing the differences between jobs and responsibilities, the way they work in our family. Maybe it helps you assign jobs and responsibilities to your children.

Board Games That Enhance Money Skills

Developing a confidence in financial skills within your children is not be completed overnight. This concept of teaching kids to be good with money, so that they learn to be financially savvy is a work in progress through all of their childhood. With that being said, there are many ways we can work with kids to help enhance their money skills. To have some fun with kids while educating them on money matters, you can try a board game night. There many board games on the market that enhance money skills, here are just a few ideas for family board game night that will help enhance your kid’s money skills.

Developing a confidence in financial skills within your children is not be completed overnight. This concept of teaching kids to be good with money, so that they learn to be financially savvy is a work in progress through all of their childhood. With that being said, there are many ways we can work with kids to help enhance their money skills. To have some fun with kids while educating them on money matters, you can try a board game night. There many board games on the market that enhance money skills, here are just a few ideas for family board game night that will help enhance your kid’s money skills.

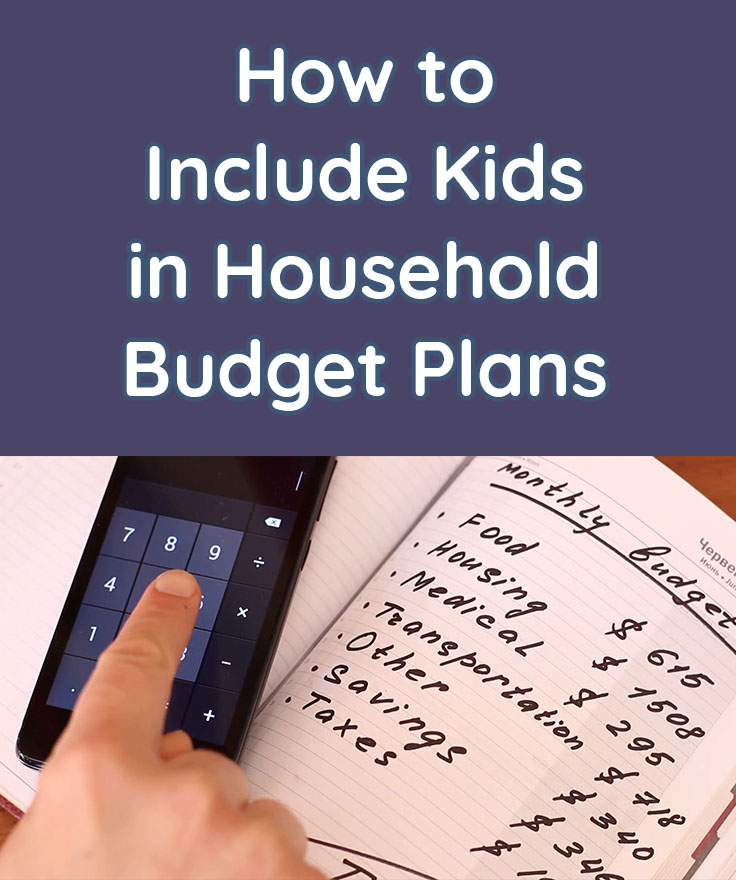

How to Include Kids in Household Budget Plans

You may have grown up in a household where kids were not a part of the everyday budget planning. Back in the day parents were more private about financial matters, but I’ve found that involving kids at an age-appropriate level with household budget plans helps them become financially savvy adults. While I’m not telling you to divulge all your household finances, perhaps there’s a middle ground where you can include kids in the household budget plans. Today we’re sharing some tips on how you can include the kids in this process so that they have stronger comprehension skills when it comes to money management.

You may have grown up in a household where kids were not a part of the everyday budget planning. Back in the day parents were more private about financial matters, but I’ve found that involving kids at an age-appropriate level with household budget plans helps them become financially savvy adults. While I’m not telling you to divulge all your household finances, perhaps there’s a middle ground where you can include kids in the household budget plans. Today we’re sharing some tips on how you can include the kids in this process so that they have stronger comprehension skills when it comes to money management.

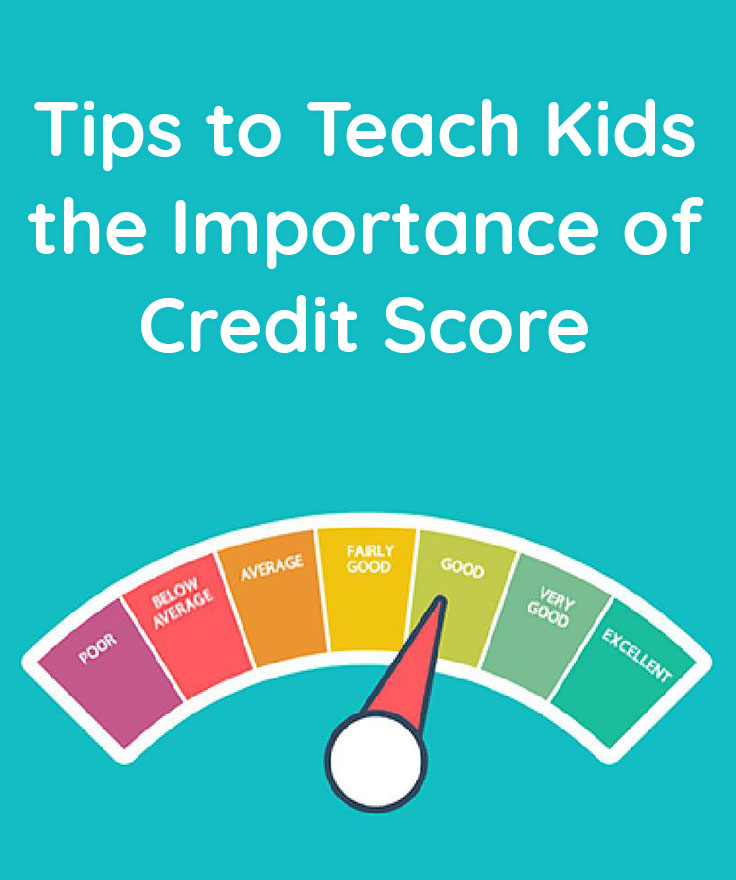

Tips to Teach Kids the Importance of Credit Score

The role of a parent is to teach their kids valuable skills such as manners, social etiquette and smaller tasks like tying their shoelaces or brushing their teeth. A parent’s job is never ending but oh so rewarding. But, one of the areas that many parents neglect to focus on is teaching their kid the importance of a credit score. Your kid may think a credit score is just another number that doesn’t matter or they have no idea what a credit score is. This all depends upon how involved with the finances your kids have been. Today I want to give you some tips on how to teach kids the importance of a credit score.

How to Encourage your Teen to Save Money

It may seem like a difficult challenge to teach your teen to save money. The teen years are certainly full of new challenges and most parents aren’t quite sure how they will survive. Reality is, every parent before you survived the teen years just fine, and I’m sure that you will too. One of the things that teens are starting to navigate on their own is money. With all the spending possibilities on offer right now, teens might not have much interest in saving for the future.

It may seem like a difficult challenge to teach your teen to save money. The teen years are certainly full of new challenges and most parents aren’t quite sure how they will survive. Reality is, every parent before you survived the teen years just fine, and I’m sure that you will too. One of the things that teens are starting to navigate on their own is money. With all the spending possibilities on offer right now, teens might not have much interest in saving for the future.

Today I want to showcase a few simple ways you can encourage your teen to save money so that they learn to be financially savvy adults.

Hands-on Money Teaching Tips for Parents

Teaching your kids about money is no easy feat.

Teaching your kids about money is no easy feat.

In addition, many of us parents themselves aren’t that great with money to being with. However, teaching basic skills like tracking spending, budgeting for purchases, and saving for long term goals and emergencies doesn’t have to go into much theoretical details. Learning can be practical and hands-on.

Today I’m sharing a few tips on how parents can use hands-on money teaching concepts to encourage kids to be financially savvy.

How to Explain Money to Kids in a Digital Age

Our previous advice of using see through jars to explain saving money to kids, and showing differences between each coin and bill is still valid. But the truth is, that the physical object of money has started to disappear. Digital age brings us even more use of credit cards. And it also adds to the mix smartphone apps and other methods to pay for items without handing over actual cash (or anything – not even a card). This can make teaching kids managing money a lot more difficult. You can’t only teach them about the physical paper and coin money. Kids will need to learn more about money in the digital age. Today I’m sharing a guide to help you explain digital money to kids in a digital age.

Our previous advice of using see through jars to explain saving money to kids, and showing differences between each coin and bill is still valid. But the truth is, that the physical object of money has started to disappear. Digital age brings us even more use of credit cards. And it also adds to the mix smartphone apps and other methods to pay for items without handing over actual cash (or anything – not even a card). This can make teaching kids managing money a lot more difficult. You can’t only teach them about the physical paper and coin money. Kids will need to learn more about money in the digital age. Today I’m sharing a guide to help you explain digital money to kids in a digital age.