While allowance is by no means a child’s right, it definitely is one of the best ways to teach children how to handle their finances. Kids need to learn the basics of money: where it comes from, how it should be spent and saved, and most importantly – that the resources are limited.

This is especially important now, when a lot of our own purchases are done online and kids don’t get to see money exchanging hands. It is easy to miss the facts that things cost money – even if we buy them online or with a credit card – which can cause financial troubles in their future.

Paying kids regular allowance is one of the best ways to teach them financial responsibility. With allowance children learn how money is used in the real world and how funds should be budgeted. Read more to determine how much allowance you should be paying.

When to start with allowance?

On average, parents in the US start giving a small allowance to their kids around age 6. But every family and every child is different. While experts agree that allowance should start around kindergarten, a sure sign that it is the right time for allowance is your child’s basic understanding of how money is exchanged for goods and how much it is worth. If your kids don’t yet know how many quarters there are in a dollar, it might be too early. Lorraine Breffni, director of early childhood at Nova Southeastern University’s Mailman Segal Center for Human Development said:

“Children begin to learn what money is – like how the different denominations work – during their pre-kindergarten years, but their understanding of the concept and value of money does not emerge fully until 6 years of age or older.”

Along with allowance being based on the child maturity, the way you pay it and amount also depends on the child’s age.

Allowance for younger kids

When the child’s expenses are mostly basic living costs allowance is not meant to pay for child’s actual expenses. When children are younger the allowance is a learning tool with which they learn how money works and is used for small things. This way kids can buy that toy they would like, pick a book for themselves or buy a sweet when they visit the store with you. They also learn how to save money towards more expensive goals. Apart from educating, don’t dictate how allowance should be spent. Don’t be angry with kids when they make mistakes – like buy a cheap toy that you knew was going to fall apart as soon as you walk out of the store. It’s better for children to do mistakes now with small amounts and learn, than to do mistakes later in life when they can be costly.

A lot of parents opt for paying $1 for every year of the child’s age – a six year old would be payed $6 per week and a ten year old would get $10 allowance every week. But you should only pay as much as you can afford – which can also be an opportunity for a talk with your kids about living within own means. Because the allowance is a learning tool, it doesn’t make any sense to try to compete with what your neighbours or friends are giving their kids.

Allowance for teenagers

When kids are old enough that they have their own expenses like mobile plans, lunch in school and visits to the movies, it is time the allowance amount reflects that. You shouldn’t have to pay extra on top of allowance, but teach your child that money is while money is used for wants, it is also used for needs. Jim Fay, author of Millionaire Babies or Bankrupt Brats: Love and Logic Solutions to Teaching Kids About Money suggests that you “let your kids make a proposal about what they want to spend money on and submit it to you.”

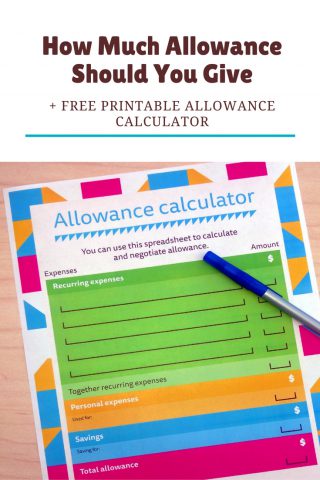

You can use the printable spreadsheet below to calculate the appropriate allowance amount with your child. Once your kid inputs his proposal you can use it to determine what purchases match your values and what amount fits your budget.

By calculating the right allowance amount your teenager should learn that a lot of income goes towards needs, and that only when those are paid for can we afford what we want and allocate some towards saving for longer term goals. Your kid will also learn that if we spend too much on personal expenses (wants) we can run out of money for recurring expenses and thus need to borrow money (this is your chance to lend them some and teach them about interests!) or take money out of savings.

All in all, it’s important to create set rules about allowance and pay it regularly on schedule and on time, so children always know what is expected. And this goes if you tie the allowance to chores or not.

BONUS: Free Printable Allowance Calculator you and your kids can use to determine and negotiate allowance: